non recoverable draw language

Draw against commission allows the employee to receive a regular paycheck based on their future commissions. The draw activities are recorded in a spreadsheet under the categories.

What Is Draw Against Commission In Sales Everstage Blog

Draws are typically a short-term incentive and a way to provide your team with income stability.

. If employment terminates during the time period of the recoverable draw employee will be. The annual recoverable draw in effect at any given time is referred to herein as. A non-recoverable draw is a draw against future commissions that doesnt have to be paid back to the employer.

Enter your email address to instantly generate a PDF of this article. The employee either by prompting or by its own volition chooses to advance some of his or her compensation from their future commission. The draw amount is typically pre-determined and acts similar to a cash advance for reps.

Just like with a Recoverable Draw if the actual commissions earned during a time period exceed the draw amount the salesperson is paid the difference. That would mean on target commissions would be 90K per year or about 75K per month. A non-recoverable draw occurs when the salespersons commissions are less than the draw amount and the draw monies are not returned or carried forward.

Employee understands and agrees that this Draw is an advance against future commissions earned a loan which Employee is responsible to pay back to Employer by way of. If you pay employees on a commission basis. I go three months till I get my first sale of 8000 so the company would pay me the regular 2000 draw they would recover the 6000 already.

For the first six months you will be eligible for the following. A draw against commission works like this. As with a recoverable draw if the actual commissions earned in a given draw period exceed the draw amount the.

This money will act as an add-on to the reps base salary and is considered. I a one-time bonus of 35000 the Bonus to be paid within the first 30 days of your employment and ii a non-recoverable draw equal to 70000 the Draw to be paid pro-rata with your bi-weekly payroll over the six month period from your hire date. A non-recoverable draw is also a fixed amount paid in advance of earning commissions but functions more as a minimum guaranteed periodic payment to the employee.

This advance can be a sporadic event or may be a regular part of the employees pay cycle where he or she receives a recoverable draw every week or month ultimately. In addition you will receive a guaranteed non-recoverable draw of 10000 against commissions for this same period. Sample Language Employee will also be entitled to receive a nonrecoverable draw of ____ per month for the first three months of employment and a recoverable draw of ____ per month for the following three months of employment.

The objectives for the additional incentivecompensation commissions are outlined in schedule A. Carefully word draw-against-commission contractsor be prepared to lose money. Impact of recoverable vs.

The Executive s annual recoverable draw rate shall be 300000 per year or 25000 per month the Draw. Many companies find that this type of outside sales arrangement enables them to hire employees with less risk than taking on a traditional salaried employees since the employees compensation is based on consummating sales. Employee may at some time during hisher employment receive a payroll advance against future commissions.

Say I work for ABC company they offer me 2000 per month draw. A non-recoverable draw is a draw against future commissions that doesnt have to be paid back to the employer. A non-recoverable draw is money paid out to keep income stable for sales reps that does not have to be paid back by reps.

The employees commission at the end of the agreed-upon period then goes toward paying back the draw. Sample Language Employee will also be entitled to receive a nonrecoverable draw of ____ per month for the first three months of employment and a recoverable draw of ____ per month for the following three months of employment. A recoverable draw works as follows.

Avoid using vague language. Non-recoverable draw This particular example is linear and is based on a compensation plan of 10 of sales with a target of 900K. Say I work for ABC company they offer me.

Specify if the draw recoverable or non-recoverable. A draw that cannot be recovered or retrieved by an employer regardless of employment status of the individual who received the draw and whether or not the draw paid exceeds commissions earned. The outside sales employee is paid a recoverable draw based on commissions earned over the course of their employment.

This is also a fixed amount of money that is paid within a specified time period. Non-recoverable draws are still paid out of commission but if the employee does not earn enough in commissions. Non-Recoverable Draw This is also a fixed amount of money that is paid within a specified time period.

The salesperson gets to keep the draw amount. If employment terminates during the time period of the recoverable draw employee will. Depending on whether the draw is recoverable or non-recoverable reps may be required to repay the draw in the next pay period more on that later.

Uncertain contract terms open the possibility of legal disputes. More tips about Employment Contract Template. English term or phrase.

Some of these cookies are essential to the operation of the site while others help to improve your experience by providing insights into how the site is being used. Also as you requested an additional recoverable draw of 20000 against commissions can be provided. The Executives draw rate shall be subject to review annually by the CEO Board or the Compensation Committee.

Does the worker get a draw. A draw against commission works like this. How does draw pay work.

It is commonly used for new sales employees for a fixed period of time. This is often used for new employees getting started or to cover times when work is slow such as vacation periods or seasoned business cycles. This payroll advance is called a Draw.

Commission earned pay cheque amount and draw balance. Signature of both employer and employee.

6 K 1 A19 5541 16k Htm 6 K United States Securities And Exchange Commission Washington D C 20549 Form 6 K Report Of Foreign Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934

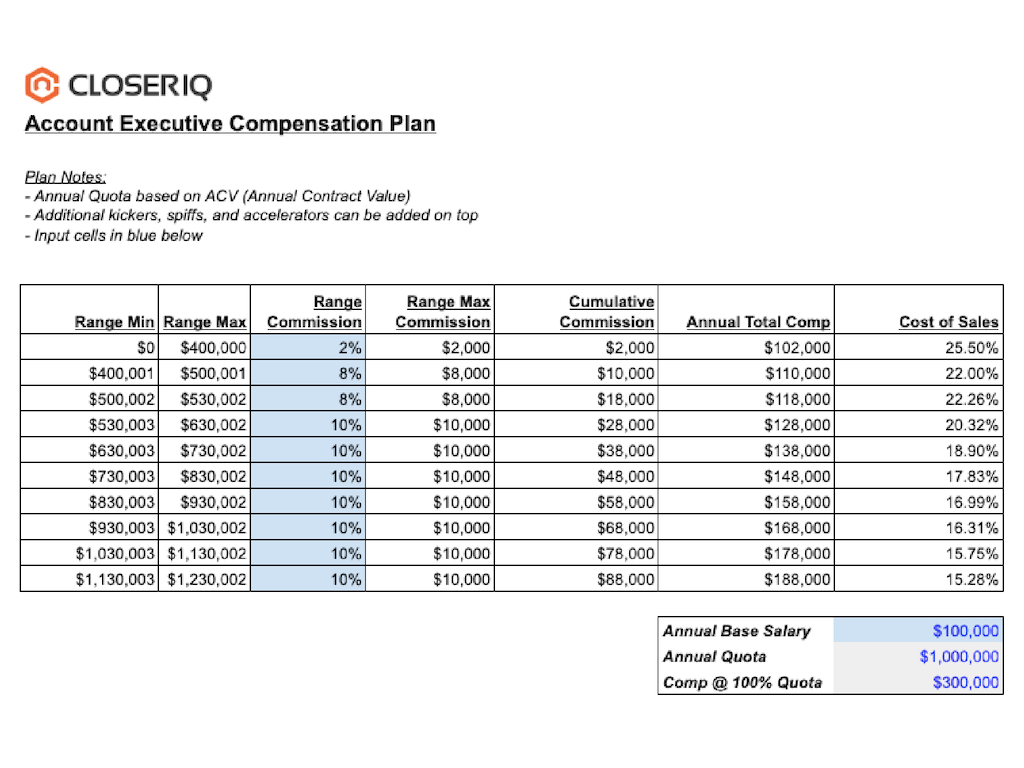

Examples Of Sales Commission Agreement And Compensation Plan Templates Bright Hub

How To Use A Non Recoverable Draw Against Commission In Sales Compensation Xactly

What Is Draw Against Commission In Sales Everstage Blog

How To Use A Non Recoverable Draw Against Commission In Sales Compensation Xactly

The Sales Recruiting Handbook Copper

How To Use A Non Recoverable Draw Against Commission In Sales Compensation Xactly

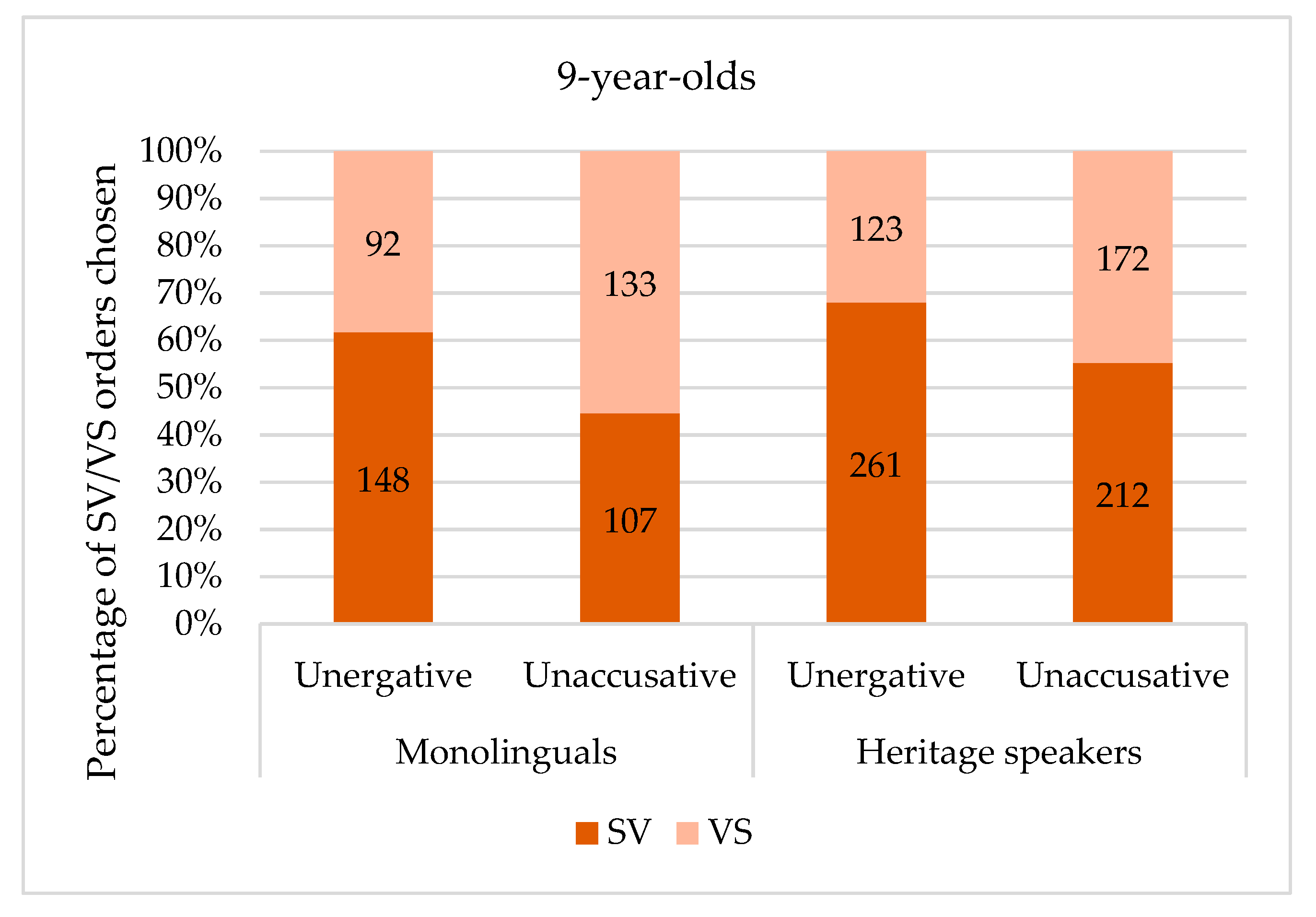

Languages Free Full Text The Development Of Subject Position In Dutch Dominant Heritage Speakers Of Spanish From Age 9 To Adulthood Html

Sales Commission Structures Everything You Need To Know Xactly

How To Use A Non Recoverable Draw Against Commission In Sales Compensation Xactly

Sales Commission Plan Template Best Of Sales Mission Structure Template Contract Agreement Contract Template Proposal Templates How To Plan

What Is Draw Against Commission In Sales Everstage Blog

Sales Commission Structures Everything You Need To Know Xactly

Outside Sales Offer Letter With Recoverable Draw Cleantech Docs

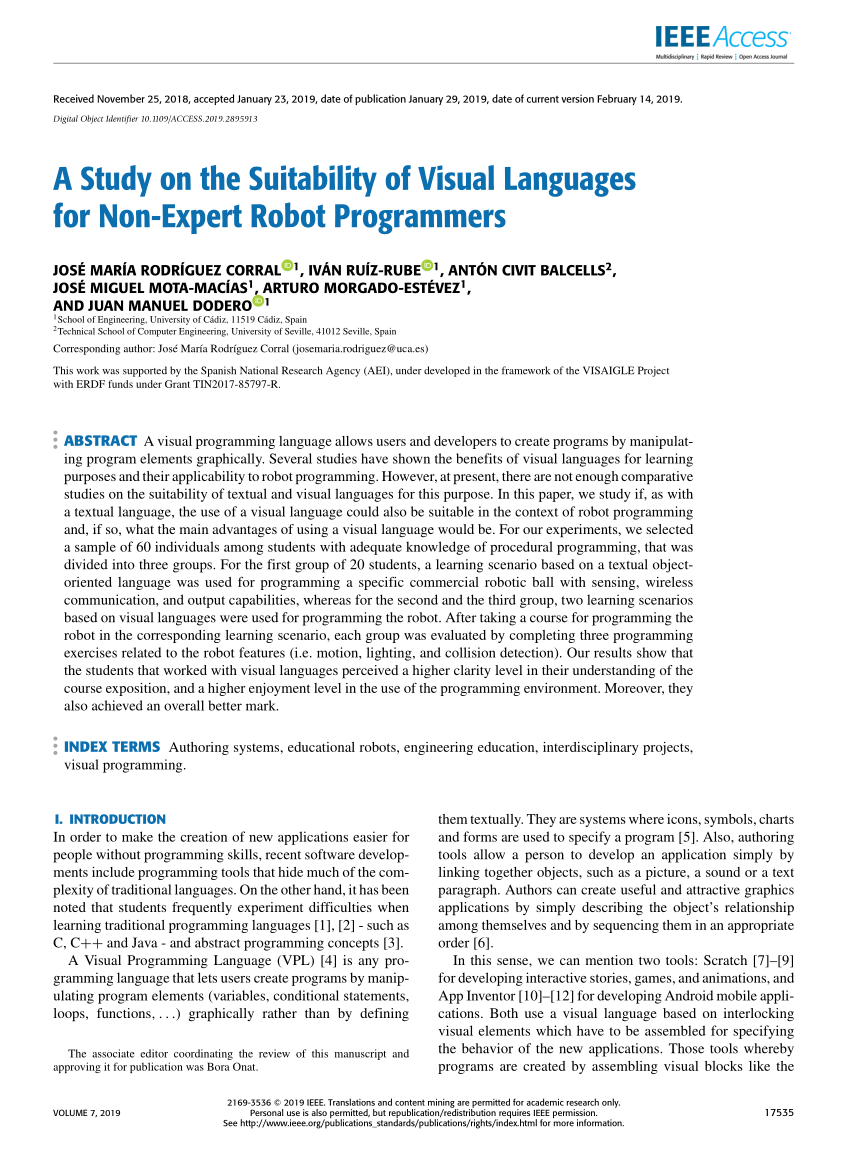

Pdf A Study On The Suitability Of Visual Languages For Non Expert Robot Programmers

How To Use A Non Recoverable Draw Against Commission In Sales Compensation Xactly

Examples Of Sales Commission Agreement And Compensation Plan Templates Bright Hub